Get This Report on Insurance Ads

Wiki Article

Insurance Asia for Dummies

Table of ContentsExamine This Report on Insurance QuotesRumored Buzz on Insurance CommissionAll about Insurance Agent Job DescriptionMore About Insurance CodeAll About Insurance CommissionThe 10-Minute Rule for Insurance Agent

Although acquiring an insurance plan that meets your state's needs might enable you to drive without damaging the law, low protection limitations don't offer sufficient defense from a financial perspective. Lots of states just require chauffeurs to have liability insurance policy, for instance. Nevertheless, this means that when it comes to a mishap, motorists can sustain 10s of hundreds of bucks of damage that they can not cover by themselves, in some cases also leading to monetary ruin.

To conserve cash, you can select a greater insurance deductible for your crash and also extensive coverage. Also though that's a great deal of money to pay in an at-fault crash, it's still much less pricey than replacing somebody's completed BMW.

4 Simple Techniques For Insurance Commission

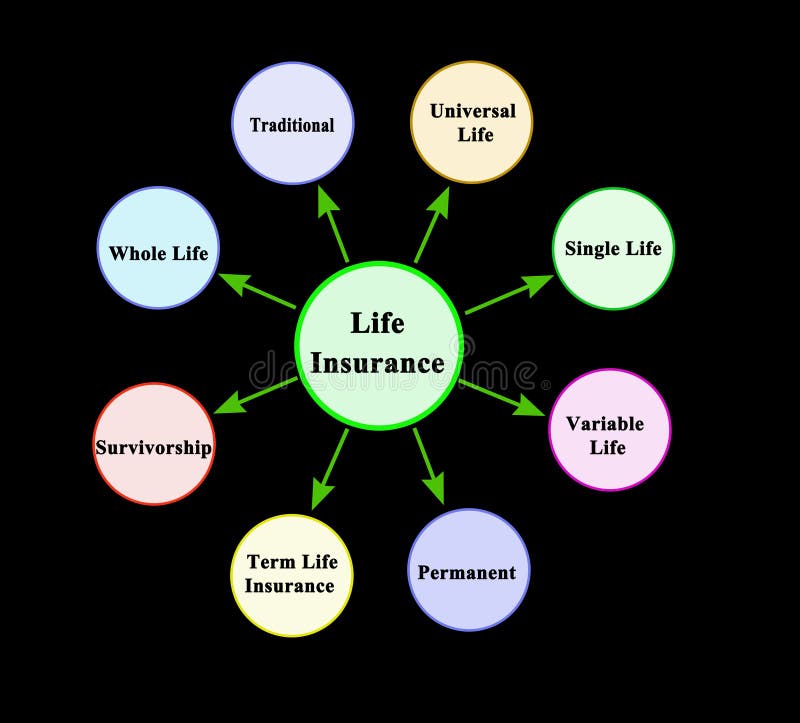

Auto Insurance Claims Complete Satisfaction Research Study, SM. What's even more, USAA has a tendency to have the cheapest full insurance coverage insurance plan out of every provider that we examined, proving that excellent insurance coverage need not come with a costs. USAA auto insurance is only readily available for armed forces participants and also their households, so most drivers won't be able to take advantage of USAA insurance policy coverage.What type of life insurance coverage is best for you? That depends on a selection of variables, including the length of time you desire the policy to last, exactly how much you want to pay as well as whether you desire to use the plan as a financial investment lorry. Different sorts of life insurance policy, Usual sorts of life insurance coverage consist of: Universal life insurance.

Guaranteed problem life insurance policy. All types of life insurance policy autumn under 2 major classifications: Term life insurance policy. These policies last for a specific variety of years as well as appropriate for most individuals. If you don't die within the time structure specified in your policy, it ends with no payout. Long-term life insurance policy.

Insurance Meaning for Dummies

Typical sorts of life insurance policy plans, Streamlined problem life insurance policy, Guaranteed issue life insurance coverage, Term life insurance, Just how it functions: Term life insurance policy is normally sold in sizes of one, 5, 10, 15, 20, 25 or 30 years. Insurance coverage amounts vary depending on the policy yet can go into the millions.

There's typically little to no cash money value within the plan, as well as insurance companies require on-time settlements. You can select the age to which you desire the survivor benefit guaranteed, such as 95 or 100. Pros: Due to the marginal cash value, it's more affordable than whole life and other kinds of global life insurance.

Some Known Details About Insurance Ads

And also since there's no cash value in the plan, you would certainly walk away with nothing. Your gains are identified by a formula, which is detailed in the policy.The best life insurance policy for you comes down to your needs and spending plan. With term life insurance insurance policy as well as life insuranceInsurance policy premiums costs are fixedRepaired which means you'll pay the same very same quantity month. Wellness insurance policy as well as car insurance coverage are required, while life insurance coverage, property owners, occupants, and also disability insurance coverage are motivated.

Examine This Report about Insurance Expense

Below, we have actually discussed briefly which insurance protection you should highly consider getting at every phase of life. As soon as you exit the working world around age 65, which is frequently the end of the lengthiest plan you can acquire. The longer you wait to purchase a plan, the greater the ultimate expense.The best life insurance coverage policy for you comes down to your demands and also budget plan. With term life insurance and and also entire insuranceInsurance policy premiums typically commonly fixedDealt with which means implies'll pay the same very same every month. Health insurance as well as automobile insurance are needed, while life insurance coverage, property owners, occupants, as well as impairment insurance policy are encouraged.

The Insurance Advisor Ideas

Below, we have actually described briefly which insurance protection you ought to strongly take into consideration buying at every phase of life. Keep in mind that while the policies below are set up by age, certainly they aren't good to go in rock. Although many individuals most likely have short-term disability with their employer, lasting from this source handicap insurance is the onethat most people need and also do not have. When you are hurt or unwell and also not able to work, impairment insurance provides you with a portion of your wage. As soon as you exit the functioning world around age 65, which is often the end of the lengthiest plan you can acquire. The longer you wait to get a insurance business policy, the better the eventual price.Report this wiki page